Do you have a friend who likes betting and would like to earn some risk-free money? Help them on their path by sharing the BowTiedBettor Substack. Win and help win!

Welcome Degen Gambler!

It is time for *the* most actionable post on our Substack so far. In previous posts we have laid out the mathematical foundations of bonus rugging, yet barely touched on the practical/executional part of the subject. Therefore our aim with this post is to compile all the necessary *practical tips and tricks* in a compact read to complement your current theoretical insights, all to make certain that you as a reader take on the bookies fully equipped.

If you have read our previous posts on BR, this practical guide will fill in any remaining holes in your BR-knowledge and consequently ascertain a smooth and successful execution of the scheme. Thus, after completion of this read, you will be more than ready to collect your first 5 000 betting $’s.

If instead this is your first visit to the BowTiedBettor Substack and you are curious about BR:

Welcome!

Begin by familiarizing yourself with the BR-concept in our introductory BR 101.

Continue by reading our bet type specific posts (attached in BR 101) and make sure you feel comfortable with the greater part of the theory.

Return to this practical post and read it thoroughly.

Cover your annual $149.99 subscription cost by taking advantage of *your first* welcome offer.

To provide a clear structure, we have decided to split this text into three main parts:

Preparation will inform you on what to do *prior* to visiting your first betting website.

Execution takes care of the middle process, starting at the initial visit of your first website, ending at completion of the whole concept.

Post-BR & Extra deals with some handy ‘after BR’-stuff.

Since the theme of the post is to help you *take action*, we have decided to almost exclusively use bullet point lists throughout the post. The bullet point format helps us organize and emphasize the important information quickly and effectively in a way that is easily digestible for you.

Preparation

Perhaps you feel like you have already grasped the idea and have no more time to waste on preparations, you are simply here to learn where to locate the money. Not so fast! A correct setup is important.

Prior to doing anything else, set up a new email (do not go with bonusrug@bookiesarezeros. com) and if possible a new phone number reserved for betting related things. When signing up with 10-15 bookies you will, in fact without you noticing, also be signing up for what bookies prefer to call ‘marketing content’. In 99 % of the cases it is pure spam and unless you want to learn how to code a ‘remove betting content from email’-bot, you are better off just setting it up correctly from the beginning.

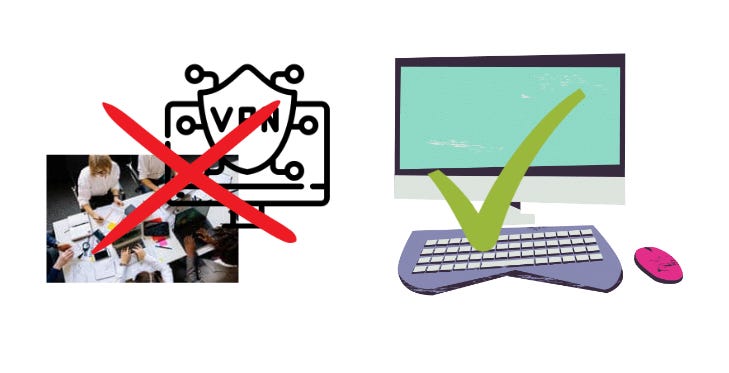

*NEVER* use VPN’s or public networks when bonus rugging. If you read the terms and conditions on any betting site you will almost always find something along the lines of,

You are eligible for one (1) bonus per person, account, household, residence, address (but not a PO Box or business address), internet connection (for example IP address), computer, mobile device and payment method (for example, a specific credit card or bank account.

This means that winnings generated on accounts linked to a device, IP or wallet previously registered with the same bookmaker are subject to being voided. As a practical rule you should wait with the bonus rugging until you are at home and have access to your own computer and WiFi-network.

Create an Excel spreadsheet to keep track of your bets and your money. Full execution of the BR-scheme entails at least 50-100 bets and to make sure the operation runs smoothly, a simple bookkeeping document is much recommended. We have, with the assistance of the excellent @BowTiedExcelWiz, created a ready-to-go BR Excel file to make this step simple for you. An Excel xlsx version (standard, no macros) is attached below. If you would like to modify something or prefer building it on your own, feel free to do so.

Visit our website, select your country, and locate the list of all available bookmakers for your state/province. Use this list to construct the ‘bookie’ column in your Excel spreadsheet.

Have you completed the above four steps? Congratulations, you are now ready for execution!

Execution

Our baseline throughout this section has been to handle the *no exchange* case, which is the relevant one for the majority of our readers. [US, Canada, …].

If you do have access to an exchange, the majority of the information provided here will still be of importance. The few things reserved for the *exchange* case are handled in exchange notes.

Now that you are ready to execute, begin by again heading over to either the website or your Excel spreadsheet to obtain the list of all the relevant bookies. Alternatively, you simply ask Google ‘STATE_NAME best betting bonuses’. Either way, you should have a number of different bookies to consider, and our recommendation is to start off the process by choosing one or two small offers to begin with. There are two reasons for this, first, if your bankroll is small/you are currently low on liquidity, it will be easier to make proper use of larger offers once you have built up your bankroll. Secondly, your familiarity with the bet and hedging process will increase successively as you go through the BR-scheme. This will (hopefully) translate into friction minimization, which in turn will yield higher percentage profits and therefore also somewhat higher dollar profits (10-15 % on $1000 > 10-15 % on $100).

TL:DR, start with BETRIVERS $250 100% deposit bonus before you try to tackle MAXIM’s $1 000 100% deposit bonus.

Having chosen your first/first two bookie/s, register on the corresponding websites (with correct bonus/offer codes if required, check T&C for the offer) and deposit the right amount of money.

Head over to our Twitter Bot @bonusruggingbot [posts daily 10:15 EST] to find today’s appropriate games for BR. Remember, if you are about to place a freebet or a risk-free bet it is *very important* to place these types of bets on higher odds (> 4, say). Visit Oddschecker or OddsTrader (both free) and check the bookie’s odds for the games posted by @BowTiedBettorII, one game at a time. Choose a game with an outcome for which the bookie offers the best odds available on the betting market, and place your bet on this outcome. If such an outcome does not exist, simply find another one where the bookie’s odds is close to top-market-odds and go with that one instead.

Alternatively, you could subscribe to a more sophisticated sports betting scraping service. These services continuously compare all the available market odds to find and provide you with the best (least ‘fees’, highest RTP) bets. Recommended services listed below:

ProfitDuel helps you locate the best games [and tells you where to hedge them]. At $30/month we’d personally go with ProfitDuel [especially since we’ve been satisfied with their European version OddsMonkey] if we were to do BR in the US today.

OddsJam offers a similar experience but is a bit more expensive at $39/month. They offer scrapers for freebets & risk-free bets and qualifying bets.

If you’re in the EU, use OddsMonkey!

Having placed your bet, you are now interested in hedging it. Preferably you will strive to do this at the best odds possible in order to minimize friction costs, and therefore you will need to identify the bookies offering the best odds on the remaining outcomes. Note that both Oddschecker and OddsTrader provide information on where to find top-market-odds for any given outcome of the game, i.e. visit Oddschecker/OddsTrader to spot these bookies.

Note: If this is your first bonus/es, you are probably not going to be registered with the sites offering the best odds already, and since our aim is to collect all welcome offers without wasting any one of them, there are some difficulty here and therefore we would recommend one of the three possible solutions.

If there exists a bookie within your state that is not offering any sign-up propositions/betting bonuses, use that one for hedging purposes on your initial bonus rugs (even if this bookmaker’s odds are slightly worse than best market odds, this is still a superior strategy). Then, as soon as a ‘bonus site’ is complete, i.e. the welcome offer has been consumed, you can add it to the list of bookies available for hedging. After 3-4 bookies this part of the process should no longer be a problem.

If no such bookie exists, try instead to find one which offers a deposit bonus on your first deposit. Claim the offer, then go on and hedge your bet with this bookie. However, make sure to avoid betting on more than one unique outcome in the same game. The reason for this can be found below.

If you are confused at this step and need guidance, ask us/another bettor in our Discord server or on Twitter.

Exchange note: If you have access to an exchange, this step becomes extremely simple since you always use your exchange account to hedge your bets.

IMPORTANT: If you have an *active* bonus/welcome offer with a bookie, you should *NEVER* bet on more than one unique outcome in any given game. Almost all bookmakers have a clause in their T&C’s to prevent naive, inexperienced bonus ruggers.

Wagering on both sides of a line on an individual game is considered bonus abuse and where there is a reasonable suspicion that the Account Holder has committed or attempted to commit a bonus abuse, [BOOKMAKER] reserves the right to forfeit the bonus allocated to the Account Holder and any winnings from that bonus.

In fact, this rule sometimes even applies to bets placed within the same business group. For example both Caesars and William Hill are controlled by Caesars Entertainment, whence betting on different outcomes across these bookies might put your money at risk.

At this point you should now have decided where you are going to hedge your bet (1-2 bookies). For that reason it is time to visit the Calculators on our website to compute how much you should bet on each of the remaining outcomes. If you wish to obtain the full picture, a complete overview of them can be found here. Choose the appropriate calculator, fill in your bet information carefully, and obtain a result describing exactly how you should place your wagers to successfully remove all variance.

Note that if you are taking advantage of multiple offers at once (an optimal strategy both in time and dollar terms) you will almost exclusively be using the Master Calculator. Usage-wise we believe that some basic trial and error should be enough to make you feel confident using it and as soon as you have come to that point you will realise the redundancy of the rest of our calculators (they are restrictions of the Master Calculator to easier cases). If you’re interested, here’s a thorough guide on the advantages with this calculator.

[Not financial advice, purely imaginary thinking]

Turbo note I: Suppose you would like to complete the BR-scheme with a friend or family member after you are done doing it using your own ID. The Master Calculator allows you to register and take advantage of *all* the relevant websites at once, effectively offering the possibility to collect thousands of dollars by spending ~ 1-2 hours a day over the range of 2-3 days…

Turbo note II: The main disadvantage with US scraping services is that they tend to focus on 2-way markets (two outcomes, e.g. moneyline or against the spread in the NFL/NBA/NHL etc.) which is suboptimal for the more advanced bonus rugger who wants to make use of multiple offers at once.

Reason: for BR you want to focus either on higher odds (> 4.00) (new offers) or on odds in the range [1.80, 2.00] (second and third bets, placed only to meet remaining turnover requirements). In a 3-way market you often find a set of odds similar to [2.00, 4.00, 4.00] which is absolutely perfect for BR by allowing the ‘rugger’ to place all freebets, risk-free bets and *initial* qualifying bets at the underdogs, while saving the “playthrough req bets” for the favourite. Taking all the bets into consideration, everything is more or less hedged by default (and then you use the Master Calculator to calculate the remaining bets you’ll have to place to *actually have it fully hedged*).

However, in a 2-way market, a 4.00 on one side disqualifies the other side (due to odds < 1.33) for the majority of bonus offers, requiring you to choose different games for your different offers & hedge your bets *one at a time* → increases turnover → bookmaker’s take eats into profits at a larger scale.Exchange note: Exchanges have a ‘master calculator’ built into their order/matching engines, hence if you place bets on different outcomes with the same exchange it will automatically optimize your position to make sure your dollar exposure is minimized. Therefore, instead of complicating things, you could simply use the Exchange Calculator repeatedly, hedging one bet at a time.

Finally, follow-through on the recommendations returned by the calculator by visiting the websites and placing your bets. Do not forget to document everything properly in your Excel spreadsheet.

Do you have a question on the execution part? Ask it in our Discord server!

Autist note: As mentioned in one of our previous posts, a common offer in the US is a risk-free bet, which if lost, is returned in freebet credits. Since the true value of a freebet is ~ 70 % of its nominal value this kind of proposition is equivalently modelled as the combination [70 % Risk-free bet, 30 % Qualifying bet]. Therefore, if offered such a risk-free bet (returned in freebets) of 1 000 USD, by instead considering it as a union of two bets, one “true” risk-free bet á 700 USD and one qualifying bet á 300 USD, you could again consult our website calculators to find out how to hedge it properly.

If the above autist note did nothing but confuse you, simply consider a risk-free bet = a risk-free bet and do not waste your time worrying about the minutiae.

Post-BR & Extra

Some quick facts regarding the post-BR stage you should be informed about:

Familiarize yourself with the tax rules for betting profits for your state/country to make sure you pay your taxes correctly. As a general rule, most European countries sportsbook winnings are totally exempt from taxes, whereas in the US the amount changes from state to state.

Reload bonuses/offers are a popular marketing tool targeted at existing customers. Consequently it is a good idea to visit your betting email/phone on a regular basis to find out whether you might have been offered any +EV propositions that could be converted into $’s.

Many betting sites offer “refer a friend”-bonuses to existing customers which both could and should be of great interest if you, after having executed the concept yourself, are planning to help one of your acquaintances do the same.

We are hopeful that this *dense* post contains everything you need to finally collect the dollars you have been promised since our entrance to the Jungle. Furthermore, since our aim is to use it as our go-to practical guide for newcomers for the foreseeable future, we will make sure it stays updated as time progresses and new information emerges.

Best of luck, anon!

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of mathematicians who moved into betting.

Another question for you.

"As mentioned in one of our previous posts, a common offer in the US is a risk-free bet, which if lost, is returned in freebet credits. Since the true value of a freebet is ~ 70 % of its nominal value this kind of proposition is equivalently modelled as the combination [70 % Risk-free bet, 30 % Qualifying bet]."

This is the most common US offer, so I feel like it could use its own post, or at least some further explanation. I'm trying to make sense of how to deal with these.

I can't just treat it as a free bet and put it all on an underdog while hedging at another book, because if the underdog wins, I'd end up losing money due to the hedge. Is this where the 30% qualifying bet part comes from? Only hedge 30% of the first bet at another book? Then if it loses, hedge the free bet at 70% of what I would for a "true" free bet at that value? Does that lock in the same profit?

I'm trying to model this type of offer as well with different vigs and odds to teach myself how it works and get my bearings, but I'm having a harder time wrapping my head around how to approach it (or how you are suggesting to approach it).