Do you have a friend who likes betting and would like to sharpen his/her action? Help them on their path by sharing the BowTiedBettor Substack. Win and help win!

Welcome Avatar!

It's time for another bonus rugging post & this time we’ll handle one of the most common welcome promotions in the US, a risk-free bet returned as a freebet [if lost]/a freebet inside a risk-free bet. As you’ll soon realise there is a fair amount of complexity to consider if one is to properly hedge such an offer, hence the in depth treatment.

Throughout this post we’ll assume familiarity with the three fundamental bonus rugging bets, qualifying bets, freebets and risk-free bets. In case you haven’t already, please begin by reading the three 101’s that introduce & discuss them.

Since, as mentioned multiple times before, bonus rugging is *extremely lucrative* and simple enough to learn for *anyone*, it is our obligation to reiterate the basics and drop some valuable knowledge on it on a regular basis. As a reader of this Substack you should have completed BR at least once [your own identity] at this point or you're falling behind.

Basics

The “freebet inside a risk-free bet”-promotion is typically offered as follows:

You’re asked to open an account with the sportsbook [as usual].

When you’ve signed up with the bookie, they offer you a risk-free bet up to X $’s, [$1 000 is common].

If you win the bet you keep your profits & the promotion is terminated with no outstanding requirements.

If you lose, they give you ‘a second chance’ by crediting your sportsbook account with a $1 000 freebet voucher. Note that this is what makes the offer different from the standard risk-free bet where your stake is returned *in cash* & is open for withdrawals immediately.

If you win your freebet, you keep any *net profits* obtained from it & are free to withdraw your money.

If you lose it you’ve lost both your risk-free bet & your freebet → 0 $’s left in your bookmaker account.

Our objective is to figure out a strategy such that no matter the outcome of the games [one or two depending on the result of the first game] we’re left with an equivalent amount of net profits.

Example: In New Jersey, the following sportsbooks currently run a version of this welcome promotion: Caesars, BetRivers, BetMGM and Pointsbet.

Variables of interest

The primary variables that will come into play for calculations of hedging amounts and P&L’s are the odds & vigs/RTP’s for both games.

Recall that the percentage you’re able to extract from a given freebet/risk-free bet offer is a function of both the odds and the vig, & that it typically lies in the 60-70 % range. Furthermore we remind you of the fact that payoff functions are identical for both freebets and risk-free bets [a $100 freebet is worth the same as a $100 risk-free bet].

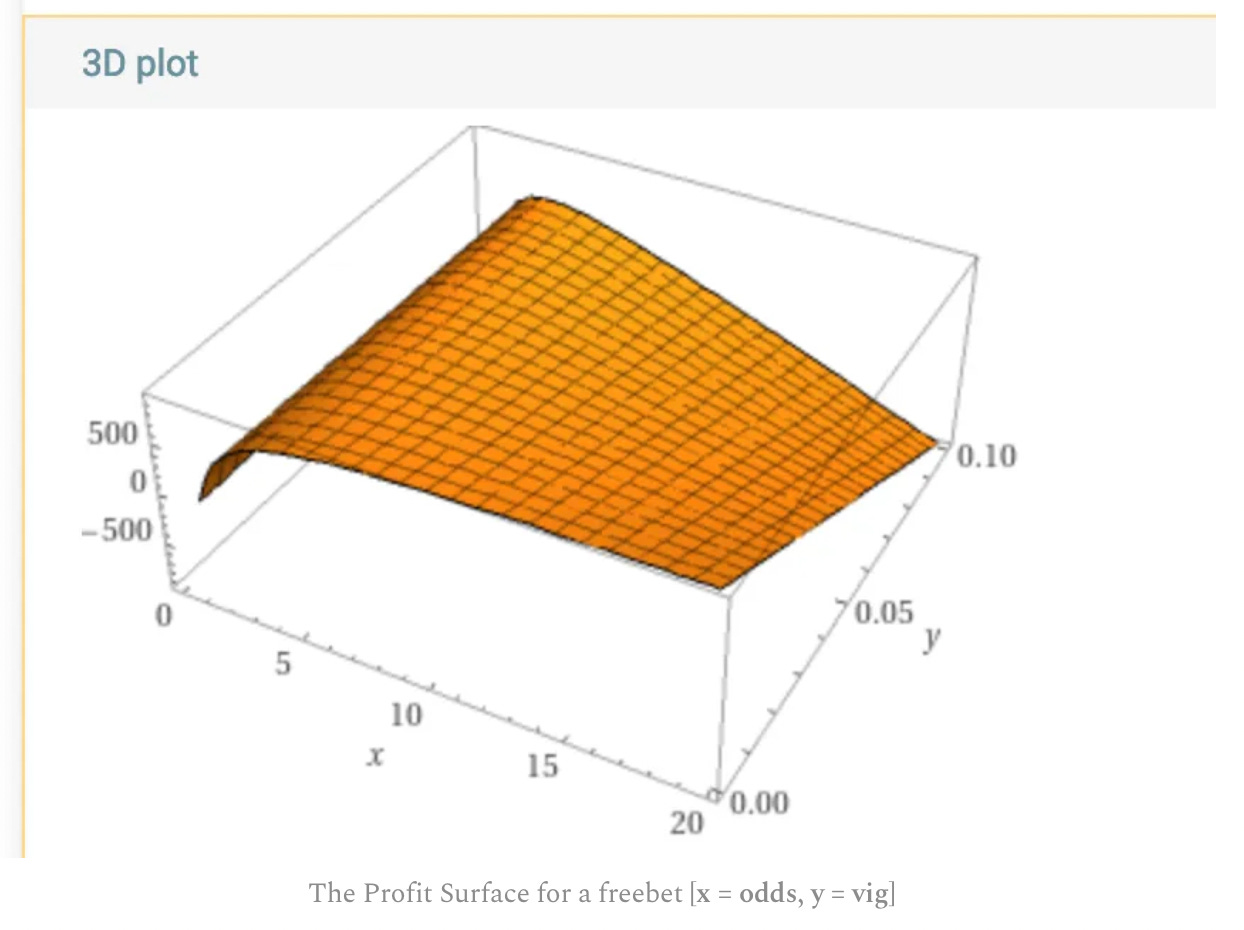

Below you find the profit surface as well as a contour plot for different combinations of vigs & odds.

Contour plot interpretation:

The lighter the colour, the larger the profit.

Along a given line, the profit stays the same.

By analyzing the contour plot, you can e.g. conclude:

Given a vig of 5 %, the optimal odds seems to be around 4.50 - 4.60. [Fix y = 0.05 and imagine walking along a horizontal line. Continue walking as long as the colour gets lighter, the stop as soon as it darkens.]

Given a certain odds, it’s always optimal to operate in a market offering as low of a vig as possible [of course].

For the remainder of this post we’ll make a practical assumption to avoid introducing unnecessary mathematical complexity for more or less zero practical reasons.

We’ll assume that a freebet is worth 65 % of its nominal value, a percentage that for example can be attained by placing a freebet on a 5.00 outcome in a 4 % vig market [which is fairly standard].

Examining the problem

This section can probably be quite challenging to wrap your head around. If you’re confused, don’t worry too much about the explanations *but make sure to use the advice presented in the ‘putting it into practice’-section below*. We’re not here for the theory, we’re here to make money, anyway. & we’re well aware numerics aren’t everyone’s #1 game.

Having laid out the fundamental assumption of a freebet being worth 65 % of its nominal value [i.e. a $1 000 freebet is really only worth $650], we’re well equipped to thoroughly approach & examine the offer.

Recall the situation:

Your first bet is a $1 000 risk-free bet.

If it wins, you’re free to leave with your money.

If it loses, you’ll obtain a $1 000 freebet voucher from the bookmaker, which, by assumption, is worth [can be converted into by use of standard freebet strategies] $650.

An alternative & very clever way of looking at the offer is to view it as a $650 risk-free bet that’s “returned in cash” [since if the risk-free bet loses, you’ll retain $650 of it at the end of the cycle after hedging the freebet as usual] coupled with an obligation to bet another $350 for no real reason other than to qualify for the required $1 000 stake. This obligation, the second part of the offer, to bet a fixed amount of money simply to fulfill wagering requirements, is what we know as a qualifying bet. Thus we can view this offer as a combination of a $650 standard risk-free bet & a $350 qualifying bet.

To prove the above reasoning we consult some mathematical machinery.

Fact/theorem: If two strategies possess the same exact payoff profile [no matter what path reality takes, the two P&L’s will always be equal] they are *equivalent*.

Therefore, if we manage to show that the two approaches do indeed generate the same payoff function/profile, we’ve proven the stated equivalence.

Under the assumption that we apply a suitable freebet strategy for the second bet, the problem can only really take two different paths.

Win the first bet.

Lose the first bet, then hedge the assigned freebet as usual which converts it into $650.

A: Observing the offer as a $1 000 risk-free bet with stake returned as a $1 000 freebet [if bet #1 loses].

First bet wins → P&L becomes $1 000 x [ODDS - 1].

First bet loses. P&L at 0$. The freebet credits can now [by application of standard freebet strats] be converted into $650 [by assumption]. P&L becomes -$350 since we made a deposit of $1 000 and only managed to generate $650 from the offer.

B: Observing the offer as a $650 risk-free bet [returned in cash] + a $350 qualifying bet.

First bet wins so P&L becomes $650 x [ODDS - 1] from the risk-free bet + $350 x [ODDS - 1] from the qualifying bet = $1 000 x [ODDS - 1].

First bet loses. The $650 risk-free bet is ‘returned in cash’ & the $350 qualifying bet is lost. P&L = -$350.

Indeed they share the same payoff profile and must therefore be equivalent.

Please note that the equivalence relies on us being able to convert the $1 000 freebet credits into $650 [otherwise this wouldn’t be true].

Read the above paragraphs again. & again. Until you *get it*.

Note: If we had gone with the assumption that the freebet is worth 60 % of the nominal value, we’d model the offer as a $600 risk-free bet & a $400 qualifying bet. In general, if the value of a freebet is considered to be X % of its nominal value, this offer is equivalently modelled as a $ (X x 1 000) risk-free bet mixed with a $ ((1-X) x 1000) qualifying bet.

Putting it into practice

Having found an intelligent perspective of the problem, we’re ready to put the knowledge into practice. How do we hedge this offer such that no matter what happens in the two games, we’re guaranteed to end up with an equivalent amount of money?

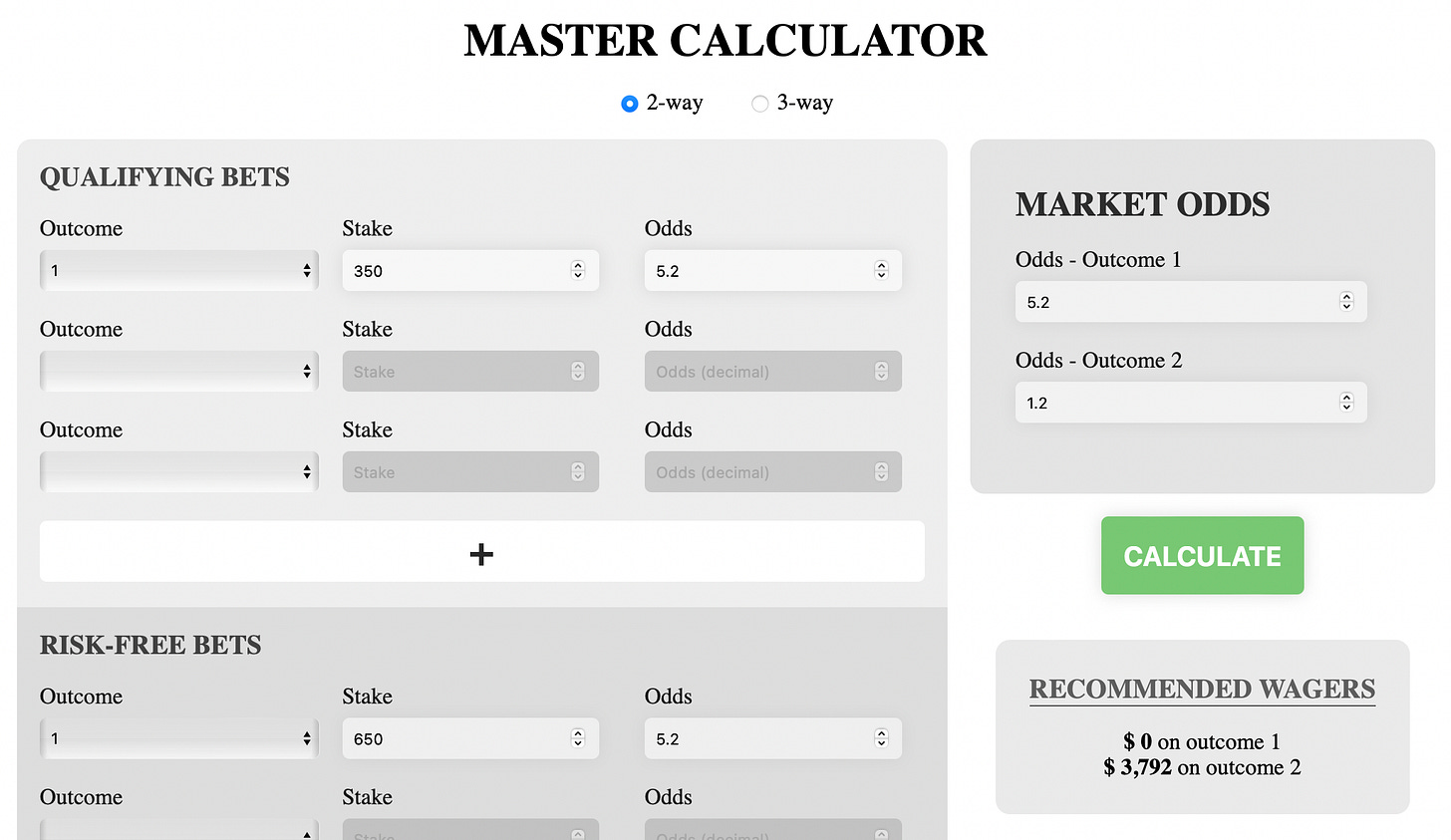

Here’s where the Master Calculator comes into play. By feeding it the combination of a $650 risk-free bet & a $350 qualifying bet, it will tell you exactly how to hedge it.

Example: Suppose there’s a NHL game tonight with the moneyline odds at [1.20, 5.20]. You’ll be placing the 1st “$1 000 risk-free bet” on the 5.20 outcome & want to find out how much to bet on the other outcome [with another bookie, of course].

Inserting the appropriate values into the calculator & letting it run yields the following result.

Hence we should wager $3 792 on the other outcome if we expect to properly hedge the offer. To verify the calculation, we again take a look at the different paths and assert that the P&L stays the same no matter which of them we get to see.

First bet wins: P&L becomes $1 000 x [5.20 - 1] - $3 792 = $408.

First bet loses. P&L is $3 792 x [1.20 - 1] - $1 000 = -$242. We’re now awarded the $1 000 freebet credits which we’ll convert into $650. Final P&L becomes -$242 + $650 = $408.

Well done, calculator!

Practical Rule: When faced with this offer, you follow the method presented above & use the Master Calculator to find out exactly how to hedge the offer.

Insights & wrap-up

Now that we’ve handled the problem it’s time to interpret the results:

The final, real value of the offer seems to be around 40 % of the nominal value the bookmakers present in their marketing campaigns [to be expected, lol]. Note that this is considerably worse than the standard 60-70 % you can generate from a *pure* risk-free bet/freebet.

An approximation that should be good enough for all practical purposes is to square the freebet/risk-free bet retainment rate to calculate the value of the offer. Hence if you’re able to keep 70 % of the nominal value for a freebet, this kind of offer will be worth 0.70 x 0.70 = 49 % → ~$490 in our case.

All the theory presented in Freebet 101 and Risk-Free Bet 101 applies perfectly well to both parts of this offer. To maximize the final profits you must therefore [naturally] maximize the P&L for each of the two bets. This is done by finding games/outcomes with suitable combinations of [vig, odds] as mentioned in the profit surface discussion above.

A great thing about this offer is that it’ll introduce you to the Master Calculator, which is a very powerful tool for not leaving tons of money at the table *for absolutely zero reasons*. Read this section of the “BR - Using the calculators & more tips and tricks”-post to understand its full potential.

The main reason we’re as detailed as we are in our posts is to prove the obvious value & *risk-free* profits BR bring about. However, when we’re taking advantage of offers ourselves we rarely follow every little piece of advice that’s shared here and typically just place the bets on a random horse or something instead.

Remember that the expected value of the offer remains the same no matter how perfect/imperfect your hedging is [in fact, since hedging costs you a small piece of the expected profits, “long term” [note that long term can be looong] you’d most likely be better off not hedging].

The #1 rationale for hedging is to remove variance & allow for higher volume [which is why we recommend it to 99 % of our readers].

Not recommending anyone to “just bet it”. But don’t worry too much if you get the hedging amount somewhat wrong from time to time.

The Most Important Thing is that you actually realise the value & *begin* to take advantage of the offers! Whether your initial execution is 100 % perfect or not doesn’t really matter.

That’s all on the most common US offer. A couple of BR & general BowTiedBettor notes until we leave you for today.

Forgot to share until now but you can rug casino bonuses as well.

1. Pick slots with high RTP’s.

2. Bet ‘longshots’ [find an improbable spin combination or something] to minimize average turnover per account.

3. Leave computer on auto-play.

More details are coming!

Some books have VIP programs with special promos targeted at high-stakes bettors. Strategy: deposit a large amount & place enough qualifying bets to satisfy their volume requirements, then use standard BR strategies to convert the offers that’ll come your way into risk-free dollars.

I.e.:

Set up account.

Take advantage of the sportsbook's welcome offer.

If the sportsbook have a VIP program, make sure to qualify for this to receive greater/more offers.

Await & take advantage of the VIP promotions [those are frequent + recurrent].

Again, more details are coming!

BowTied BetPicks has now been up & running successfully for ~45 days and attached below are a couple of standard performance metrics. As per requests there are now channels available for UK/IRE, Spanish & Swedish subscribers [with links to each country’s relevant bookmakers]. An Australian Channel will soon be launched [currently in beta version], expected in a few weeks time. Note that Minimum Bet Laws apply in Australia, making the kind of strategy [Betfair Steamers] underpinning BowTied BetPicks incredibly lucrative. Stay toon’d!

More Stats & Graphs for the service available here.

That’s all for today, anon!

Until next time…

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of mathematicians who moved into betting.