Do you have a friend who likes betting and would like to sharpen his/her action? Help them on their path by sharing the BowTiedBettor Substack. Win and help win!

Welcome Avatar!

Our second Q&A has been planned for a while. Now it’s finally here! Naturally, since the majority of our most active subscribers are bonus ruggers, a fair share of the Q&A’s will be dedicated to BR questions.

Q&A Structure

We receive questions on Twitter, in DM’s and in our Discord server.

Occasionally, we compile the ones deemed most relevant for all of you in a Q&A and provide careful answers to them.

If, after reading the Q&A, you have additional questions, you are of course welcome to ask them in the comments section below.

Q1

“I come from fintech and am looking to build. Ideas on software that could be useful for sports bettors?”

Bet History Trackers/Spreadsheets with integrated data analysis. We’re using custom built Excel sheets to track & analyze our bets but would be happy to try out products offering sophisticated analytics, in particular those able to find/suggest well performing/not so well performing clusters & patterns within the data [even if noisy]. Integrations [read permissions] with sportsbooks/exchanges preferred.

Odds Screens always going to be a thing since comparing prices across bookmakers is crucial for any serious betting operation. In our opinion, less is more here. Prices on all relevant bookmakers combined with price graphs tracking the evolution of the odds throughout the day is enough. No need for thousands of extra features.

Not sure of the English term for this but “Reduction Tools” for Pick-N markets.

A Pick-N market is basically a market where you win if you manage to find the winner in N consecutive [& predefined] games/races. Since the number of possible combinations scales exponentially with the number of games/races [if 15 games with 3 outcomes per game, there are 3^15 possible outcomes], no one can afford to bet all the combinations.

Advanced bettors on the hunt for the best combinations tend to [initially] cover a great deal of the possible combinations, then use software to *reduce* [hence the term “reduction tools”] the number of combinations through certain rules & filters [at each step the rule/filter removes a subset of the remaining combinations]. When all of the rules & filters have been applied, what’s left is [in theory] the combinations containing the most +EV. Advantages with building this kind of software:

You’ll naturally have to become sharp to offer the right kind of methods [or no one will use it], effectively generating an [in some cases very lucrative] edge in high-volume markets.

You’re free [or you’ll do it anyway] to spy on & learn from *sharp* actors.

Historical betting/sports data sites. Acquiring historical betting/sports data isn’t the most trivial thing to do. Thus, by spinning up a site, building up a database & reselling the information in a user friendly way you can construct a money making machine. Examples:

Betwise - past data on UK horse racing.

Betdata - past Betfair data on political betting. Basically storing Betfair election data continuously & using figures/graphs to represent it visually, thereby providing a great experience for curious election bettors.

Check out our “A gentle introduction to the Betfair API” to get started with the collection of both present and historical exchange odds data.

Q2

“Several sign-up bonuses in my state have been significantly reduced (e.g. FanDuel from $1 000 to $150; Hard Rock from $1 000 to $200). Do these offers typically cycle throughout the year such that I should hold off on signing up until they improve?”

There’s some seasonality in it, but the long term trend is bad. Bookies are constantly refining their offers to make life harder for bonus ruggers [BR costs bookmakers a lot of money] so the obvious advice here will always be to collect whatever money is on the table as soon as possible. US are far behind Europe in terms of “anti BR-measures” and as a consequence you should expect welcome offers and other bonuses/freebets to get worse as they catch up.

Another reason to take advantage of the welcome offers as soon as possible is reload bonuses, i.e. bonuses offered to existing customers. While you’re waiting for months with the sign-up offers you’ll miss out on a lot of valuable freebets & reload offers.

Q3

“I am new to modelling sports and I don’t quite get the importance of understanding odds movements?”

Odds moves can be relevant for several reasons, including but not limited to:

In parimutuel/tote betting you're interested in learning the closing odds before they're seen (final odds are decided when the horses leave the gate) to calculate EV’s & sizing, or to include them in models that are using the public’s estimate as a covariate.

An ability to predict odds movements can easily be converted into [plenty of] dollars, either through exchange trading [back before an odds drop, lay afterwards] or, in markets lacking proper exchange liquidity, by knowing *when* to bet in order to acquire the best possible odds/price. A horse with a 20 % probability of winning offered at 6.00 is +EV, but if you can get it at 7.00 in an hour the optimal choice is of course to wait.

There's often *information* & valuable insights in odds moves. These insights can shed light on aspects you may have overlooked or not yet considered, ultimately enhancing your predictive abilities.

It lets you “chase steam”. Steam Chasing is a strategy where a bettor can move quickly to get down a wager at a slower sportsbook that has yet to change their line with the rest of the market.

On the subject of steam chasing: Currently in the midst of a BowTiedBettor project that will launch later this year. How about a real time data feed containing every single one of the latest *informative* odds drops?

By continuously letting our self-built BowTied BetBot scan & interpret the activity on the sharper segments of the betting markets, we are able to identify what clever market participants are doing.

In real time.

Using this information, we can then hit bookies from all over the world with our action long before they have been able to react to the new pieces of knowledge that have entered the markets.

Latency arbitrage if you will.

Stay toon’d!

Q4

“What do you know about utilizing sportsbooks in neighboring states that are not available in my state? For example - I could drive about an hour and be in another state which has 11 more sportsbooks than my state. Do you know if I am able to spend the day in that state, sign up on those 11 apps, and BR, despite not living in said state?”

Disclaimer: we’re not US based and haven’t tried it out ourselves. However, after following discussions about this in numerous places we’re fairly confident that it indeed should work. Note that this is for bookmakers *not* available in your state. For bookmakers operating in both states, it seems to vary on a case by case basis whether “double dipping” [i.e. repeated use of the welcome offer] is allowed or not.

Q5

“Hi Bettor, I read through all the BR Substacks and was wondering in your experience what volume of bets I should be expecting to do to take advantage of 7 offers in the U.S. in my state (Barstool, Draftkings, etc.) - specifically, if I’m going to running up a significant amount of hedged wins.

For example, if after cycling through all of the offers I have $30k of paper wins and $30k of losses after hedging, it wouldn’t be profitable to run the strategy from a tax perspective as (1) the tax burden of $30k in income if I didn’t itemize deductions on my taxes would outweigh the $5k of income from the signup bonuses, and (2) if I itemized deductions I would miss out on the $13k standard deduction and would also be paying taxes on the $5k of income from sign up bonuses - this would essentially wipe out the income from the bonuses. '

However, the bonus rugging would be profitable if at the end of it I only had ~$15k of paper wins hedged with a matching amount of losses. From what you’ve seen is the lower amount of paper wins likely?”

Great question since it hits on an important point: always check tax rules & local betting laws prior to engaging in any serious & systematic betting activity whatsoever.

Maximize earning potential, but do so while paying your taxes and following local laws. Game the system to its max but not more.

To answer the question, a friend of ours shared a document containing BR-data on 257 different identities.

All bonus bets have been placed at various bookmakers and hedged at a single, unique betting exchange.

Deposits of about $2 000 have been completed for each person/identity.

Average of 10 books/person.

Minimum paper profit is $2 000/person, a number generated whenever sportsbook profits have been less than $2 000 [if $1 200 in total have been withdrawn from sportsbooks, the remaining $800 must have been lost & will therefore show up as a profit at the exchange].

For persons/identities with total sportsbook withdrawals exceeding $2 000, no paper profits have been generated at the exchange [i.e. the paper profits = sum of withdrawals].

Paper profit is defined as “the total net profit generated during the year *at a single bookie*” [i.e. a definition that allows for deductions of gross losses *per bookie*]. If the definition is changed to “total gross profits generated during the year” the numbers will look much worse.

A histogram of the observed paper profits provided below.

Q6

“Is it weird that Barstool and Unibets APIs are identical?”

No, it isn’t. Rarely do retail bookmakers have [all] their pricing in-house. Instead, what they do is to outsource this part of the business to odds providers that offer overall solutions [with allowance for some parameter twisting] for the bookies to integrate with their websites. In this case, since both Barstool and Unibet employ Kambi as their odds provider, they’ll consequently be fetching their odds from the same source.

Retail bookmakers are not bookmakers, they’re marketing companies.

Q7

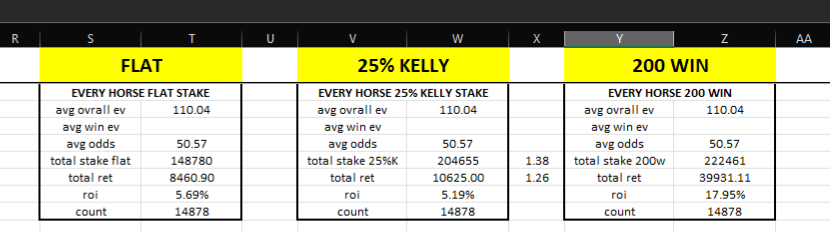

“How does one determine if one’s sample size of bets is sufficiently large to separate signal from noise? I've a dataset with last 14 878 horse picks (theoretical, getting on everyone isn't possible for unrelated reasons) but am trying to transition to finding an edge at BSP [Betfair Starting Price], so have obtained BSP for all 14 878 picks and filtering to assess profitability. Thoughts on the results?”

[BACKTESTING DATA INCLUDED BELOW].

First of all, please read our comprehensive analysis of bet sequences/bet history/backtests here to create a fundamental understanding of the different aspects of the problem. Reducing such a treatment to a couple of sentences is more or less meaningless since it inevitably removes the essence of the theory/thinking.

If you’re looking for a very rough measure which may offer *some* guidance, consider this method mentioned by @seawake in our Discord server:

“As an approximate, can pretend it's all identical binomial and calculate the standard deviation as sqrt(n*p*(1-p)) where p= 1/avg_odds. Then see how many standard deviations of winners over you are, and pretend your prob is normal and look up the p value. Which is the chance of your result purely by chance, think your all results is ~16% by pure change and your weekday is ~6% by pure chance.”

In your backtests you’ve been running flat stakes staking strategies as well as Kelly strats. Flat stake backtests/Kelly backtests differ in several ways. Would take hours to write up something useful on this so will have to be long form (at some point) on the Substack.

As an example: backtesting with flat stakes then going live with Kelly can be dangerous. The standard reason: when you disagree with the market [i.e. you believe a bet to be +EV], you’re almost always overestimating/mispricing or even missing at least *some* factor/factors. You may be correct in that the price is off, but it’s probably less so than what your estimates say. I.e. the true price lies in between your price & the public’s price. For flat stakes this doesn’t matter much [resulting in great looking backtests] but when transitioning into Kelly staking you’ll unfortunately be overbetting [the probability you feed the Kelly Calculator is too high] → real world growth/results turn out to be terrible or at least much worse.

Weekday racing/weekend racing could definitely differ in profitability. For instance a fundamental model (if that's what you're doing) would probably perform better when the rest of them (the ones ran by other “fundamental participants”) are inactive/the market is primarily looking at flows/odds moves etc...

Conclusion & a couple of notes

That’s the content for today, feel free to ask questions in the comments section below if anything is unclear.

Couple of notes before we leave you:

Next post is the final one of the DraftKings web scraping project.

Seems like both TVG & TwinSpires offer US customers to place bets on Swedish & French horse racing. If there's demand for it, we might share some thoughts on interesting races going forward.

Until next time…

Disclaimer: None of this is to be deemed legal or financial advice of any kind. These are *opinions* written by an anonymous group of mathematicians who moved into betting.