The generalized Kelly Criterion

LEVEL 5 - SHARP

Welcome Avatar!

In our previous introduction to the Kelly Criterion, we considered the importance of sizing your bets correctly via a discussion of the concept of expected growth and a presentation of the basics of the theory of bet sizing/portfolio optimization. The main question was whether there for any plausible betting proposition was possible to find a ‘perfect’ bet fraction, one that is optimal in the sense of always outperforming any other fraction. If the bettor’s objective is optimization of long-term growth, both existence and uniqueness (under some mild conditions) of such a fraction was proven.

Now, the realisation of the fact that a solution to the above problem of finding the ‘perfect’ fraction when offered a *single* bet exists, naturally gives rise to another engaging question. Could the same idea hold true in a more general, multidimensional case, where instead of a unique opportunity a full *set* of betting propositions are taken under consideration?

The theme of this post is to answer this question by discussing whether or not a construction of such an extension is achievable.

Quick note: Now that the necessary BR-material has been handled, we have a couple of more general betting subjects coming up on the Substack. After running the below poll earlier this week,

we decided that the release of this mathematical piece should be prioritized to quench the thirst of all the autists in our following.

An updated version of the problem

Note that this text assumes that you have read and understood the one-dimensional case and feel comfortable with increasing the level of abstraction. Since the closing notes in the 1D Kelly intro (which discussed the theory’s practical applications) are as relevant for the n-dimensional case, we recommend you (instead of repeating ourselves) to reread those thoroughly after completing the rest of this treatment. The remainings of this post will consequently be restricted to the mathematical details of the problem.

First, we begin by recalling the situation leading up to the one-dimensional case.

You find yourself in a position with a +EV betting opportunity and realise that you should probably execute a trade, one way or another. This immediately gives rise to a very interesting question, how much should you bet?

If your goal is to simply maximize the expected value in dollar terms, then the correct strategy is to bet as much as possible, i.e. your full portfolio. It does not require much thinking though to realise that this is an extremely unintelligent approach, within only a couple of bets there is a great chance you will have gone bust already and, in fact, with probability one you will go broke sooner or later if you continue indefinitely. It suffices to say we should be able to do better.

At the other extreme, you do not want to completely waste the opportunity, if there is positive expected value offered, you somehow want to collect at least a bit of it.

This leaves us with an intriguing situation, perhaps best summarized in three main objectives:

+EV opportunity → want to bet more than 0 $.

Uncertain event → cannot risk full portfolio.

Want, for self-explanatory reasons, to introduce some dependence on portfolio size → bet a *fraction* of total bankroll.

Translating this thinking into our new setting, what differs is that we are now faced with a *multiple* of favorable betting opportunities, and are aiming to find a ‘perfect combination of fractions’ to wager on the different events such that our long term portfolio growth is maximized. The question is, how do we solve this fairly technical optimization problem?

A naive approach would be to consult the existing 1D Kelly formula repeatedly by feeding it the information for one bet at a time, looping through the bets until the full set of n solutions have been computed. It is however not hard to see why this procedure would fail and an excellent way to understand the intricacies of our extension is to try to come up with counterexamples (there are many) for which this strategy becomes dangerously flawed.

A treatment for the sonic autist

As seen is the previous paragraph, hoping to solve this extended problem by applying our current knowledge does not take us far. Accordingly, we are forced to invent new techniques to handle these kinds of more generalized/less restrictive situations and this is exactly what is done below.

Substack is unfortunately not LaTeX-compatible and since more advanced mathematics more or less requires LaTeX for readability purposes, this part of the post, handling the mathematical statement and solution of the problem, has been attached using images. If preferred, a PDF available for download has been included as well.

Two examples

After having delved deep into the mathematics, we will now reduce the complexity somewhat by analyzing two fairly simple examples for the purpose of practical insight.

Example 1: You are offered to bet on two independent coin tosses that are to take place at the same point in time. Both coins are loaded, and they have a 60 % probability of coming up heads and a remaining 40 % chance of tails. However, 2.00 is the odds offered by your bookie on all available outcomes and consequently it is clearly in your interest to have a portion of your money invested. The question is, how much should you wager on each coin toss?

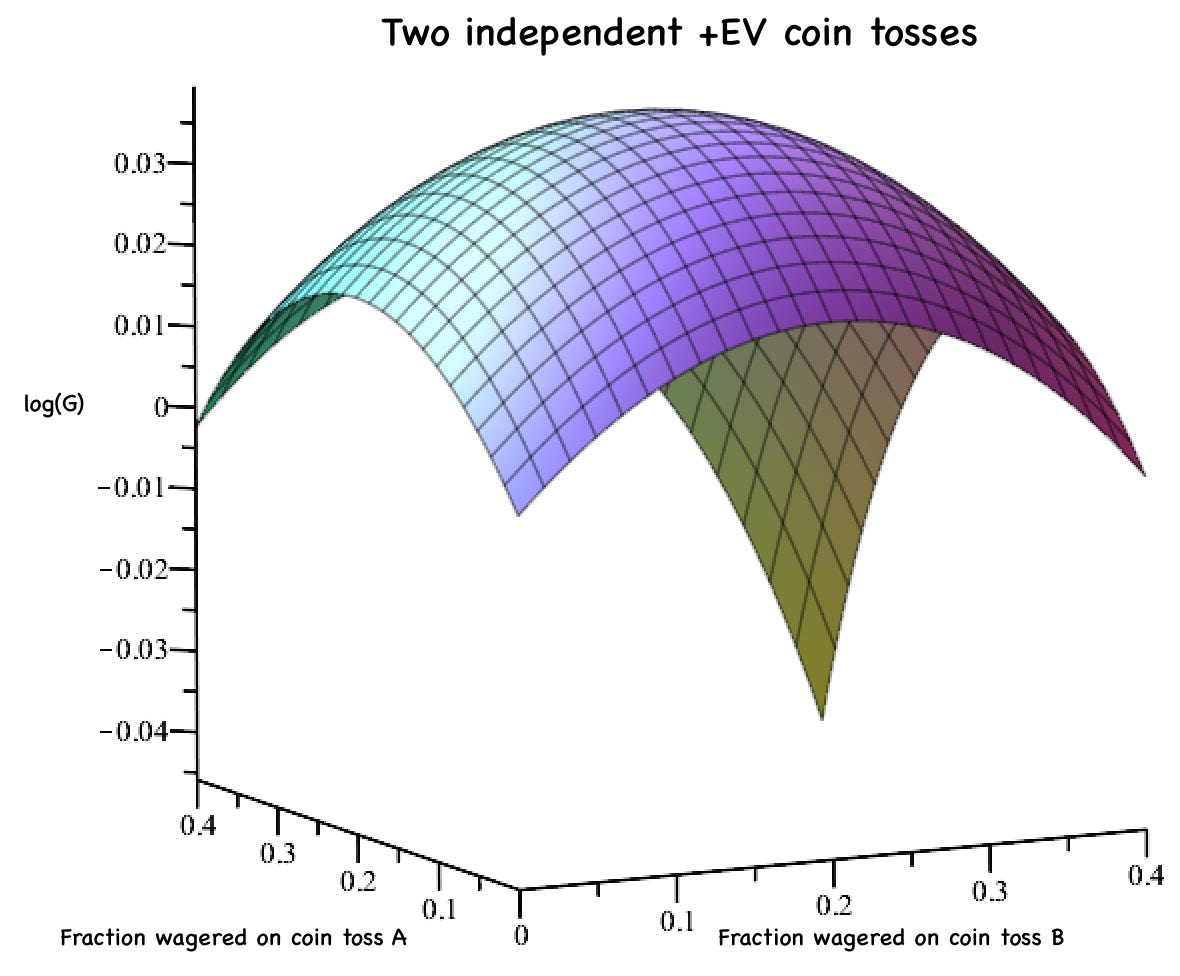

By setting up the equations correctly and letting Maple do its job, we obtain the following Kelly surface describing the dependency between the portfolio growth and the different combinations (f_1, f_2), with a maximum attained at (0.16, 0.16). We conclude that both opportunities deserve an equal investment of 16 % of your portfolio.

Example 2: You find that two horses competing in the same race are incorrectly priced by the market. One is available at 3.00 with a 40 % win probability while the other one is offered at 6.00 with a 20 % chance of winning. Both bets are definitely +EV, but what is the optimal set of wagers? According to Kelly, a wager of 13.3 % on the 3.00 horse and one of 6.7 % on the 6.00 option!

What is to come?

Now that we are all Kelly gurus and know how to make optimal use of +EV openings, we are prepared to launch into less abstract/more practical territory in the coming weeks. A few hints on what is to come on our Substack:

An introduction to the Betfair Exchange API. Why bet manually when you can do it programmatically? The bots are coming!

Penalty shootout models. World Cup 2022 is not far away and it will be interdasting to see the Jungle move the shootout lines in the playoffs.

More practical BR-material, specifically guides on the most common offers.

Web scraping resources, a review of different tools and approaches combined with helpful examples of finalized scripts.

An outline of the NHL project.

That is all we have got for today!

Until next time…

Do you have a friend who likes betting and would like to sharpen his/her action? Help them on their path by sharing the BowTiedBettor Substack. Win and help win!