Do you have a friend who likes betting and would like to earn some risk-free money? Help them on their path by sharing the BowTiedBettor Substack. Win and help win!

It has been a while since we last released a pure BR post. Since, as mentioned multiple times before, bonus rugging is *extremely lucrative* and simple enough to learn for *anyone*, it is our obligation to reiterate the basics and drop some valuable knowledge on it on a regular basis. Therefore, today’s post will explain the practical aspects of the website calculators in depth plus provide further details regarding the execution of the BR-scheme.

Note: As a reader of this Substack you should have completed BR at least once [your own identity] at this point or you're falling behind.

There are currently five BR-calculators running on our website, four very simple ones and one created mainly for more sophisticated bonus ruggers. We’ll begin with a quick overview of the first four and then expand more thoroughly on both the workings and the advantages of the more general Master Calculator. If you are serious about BR, this section is guaranteed to offer some crucial insights.

Qualifying Bet Calculator

The qualifying bet calculator should be absolutely trivial to understand for anyone who has read our previous posts on BR.

Visit Qualifying Bet 101 if you are unfamiliar with the term and/or want to understand the maths behind it.

Example: You have placed a qualifying bet at one site and want to hedge your position using another sportsbook. Suppose you’ve wagered $ 500 on The Draw in Villarreal - Real Madrid at odds 3.90. Currently the best odds on the two remaining outcomes {Villarreal, Real Madrid} are 3.70 and 2.03 respectively. Plugging these numbers into the 3-way (three outcomes) qualifying bet calculator and letting it calculate the result yields the below output.

Thus, $527 should be placed on Villarreal to win and $960 on Real Madrid to win. Indeed, an examination of the three possible outcomes verifies that the calculation has been performed correctly.

Case 1: Villarreal wins the game.

Case X: The game ends in a draw.

Case 2: Real Madrid wins the game.

Note: The net loss -$37 can, perhaps more informatively, also be computed in a slightly different fashion. The RTP for the market is 0.981 (how did we arrive at this figure?), or equivalently, the bookmaker’s take is (1 - 0.981) = 0.019. Multiplying the bookmaker’s take by the total amount wagered returns

i.e. the same as above. Using the same kind of thinking we could, by removing the $500 from the above equation, compute the total cost of hedging our position (assuming market probabilities give a fair assessment of reality, why?), which in this case turns out to be $28.

Unless there is an arbitrage, a qualifying bet will always yield a negative result when hedged properly. However, since it is always the case that you have received some kind of bonus money from the site at an earlier stage in the process, you are still guaranteed to leave the site with a net profit. What is important is to minimize the realized loss per qualifying bet while being in the “wagering to meet rollover requirements” part of the process.

When looking for qualifying bets, we would recommend restricting yourself to RTP’s above 0.98. How do you find such markets? You could for example use this bet finder at OddsJam [39$/mo] to locate the best available games for qualifying bets in the next 24 hours, alternatively you find them manually using the methods described in our practical post.

Freebet Calculator

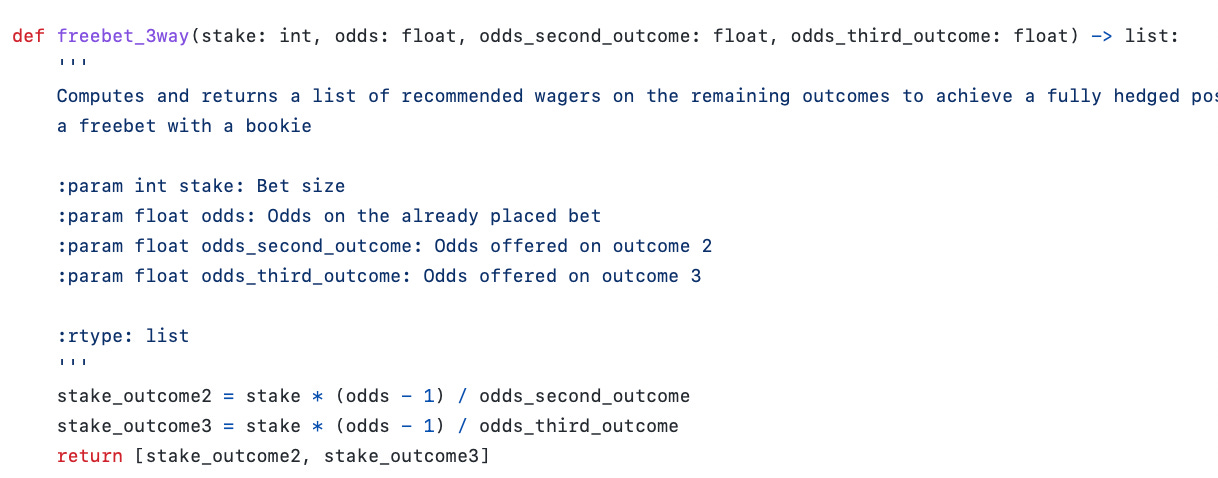

Computes how much to wager on the remaining outcomes (one or two) after placing a freebet.

Example: You have bet $250 freebet dollars on Las Vegas Raiders [Moneyline] at 4.50 [you remember the importance of choosing high odds outcomes for freebets, right?] against Kansas City Chiefs. DraftKings offers 1.25 on KC Chiefs and so you decide to hedge your bet over there. Feeding the freebet calculator those numbers, you get the following response.

Hence you visit DraftKings and bet $700 on LV Raiders to win.

Payoffs?

Case 1: KC Chiefs wins the game [remember that losing a freebet does not cost you any money].

Case 2: LV Raiders wins the game.

In this case the net profit is 70 % of the nominal value of the offer, a reasonable conversion ratio for freebets and risk-free bets [commonly 70-75 %]. As a basic rule of thumb we would suggest a lower bound of 65 %. If less than 65 % of the value is retained, you skip that particular market and look for another game.

Note: The RTP is not the sole decider when searching for suitable markets for freebets. It is the *interaction* between the RTP and the odds that determines the freebet conversion ratio. For a fixed RTP, a higher odds is preferable. Similarly, for a fixed odds, a higher RTP is better. Again, if you’re willing to pay for the service, OddsJam [39$/mo] offers a scraper for finding the best available games for freebet purposes here.

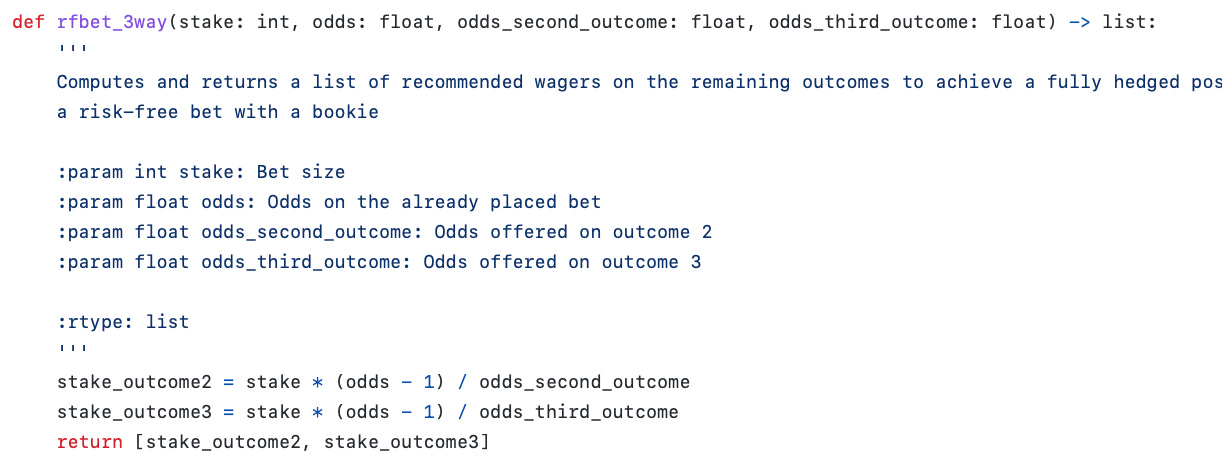

Risk-free Bet Calculator

As we have touched on multiple times by now (e.g. in the autist note here), a risk-free bet is mathematically equivalent to a freebet. You could for example see this by inspecting the code for the two calculators and notice that they are just copy pastas of each other. Therefore: what is true for a freebet is always true for a risk-free bet, a fact that one may bear in mind going forward.

Example: Barstool offers a risk-free bet of $1 000 to new customers. To claim it, you set up an account at Barstool and head over to the freebet converter at OddsJam. Columbus Blue Jackets at 3.75, hedged with WSH Capitals 1.31 at Bet365 seems fine. Plugging the numbers into the risk-free bet calculator, you receive the following recommendation.

Case 1: Columbus Blue Jackets.

Due to email length limits, this post has been divided into two parts.

Click here to continue your reading!